Similarly, if you have a background of having car insurance policy plans without filing cases, you'll obtain less expensive rates than a person who has submitted claims in the past. cheaper.: Automobiles that are driven much less often are much less most likely to be associated with an accident or other harmful occasion. Autos with lower annual gas mileage might get approved for somewhat lower prices.

To find the very best automobile insurance coverage for you, you need to contrast shop online or talk with an insurance policy agent or broker. You can, however be certain to track the insurance coverages selected by you and offered by insurance companies to make a fair contrast. Alternatively, you can who can aid you locate the ideal combination of cost and also fit.

Independent representatives help multiple insurance provider and can contrast among them, while restricted agents benefit just one insurance coverage business. Provided the different ranking methodologies and also elements utilized by insurance companies, no solitary insurance provider will certainly be best for every person - vehicle insurance. To better comprehend your regular automobile insurance policy price, spend time comparing quotes across business with your selected method.

The ordinary expense of cars and truck insurance is $1,655 per year for complete protection, according to 2022 rate information. Right here are some key realities regarding cars and truck insurance policy rates: Bankrate understanding New York, Louisiana as well as Florida are the three most expensive states for car insurance policy on average.

The Buzz on What Is The Average Cost Of Car Insurance In California?

dui insure trucks automobile

Having a severe infraction like a DUI on your automobile document might increase your auto insurance policy premium by 88% typically - cars. Teen male motorists may pay $807 more for vehicle insurance typically compared to teen female drivers. How much does car insurance expense by state? Answering, "How a lot does vehicle insurance policy price?" is a little bit difficult, as it differs based upon several elements, including the state where you live.

vehicle insurance business insurance insured car cheapest auto insurance

vehicle insurance business insurance insured car cheapest auto insurance

To find the best auto insurer for your needs, get quotes from a number of vehicle insurance firms to compare rates as well as attributes. The table listed below displays the typical yearly as well as regular monthly premiums for several of the largest vehicle insurance provider in the nation by market share. We've additionally computed a Bankrate Score on a scale of 0.

cheap car insurance vehicle vehicle insurance car insurance

cheap car insurance vehicle vehicle insurance car insurance

Note that your age will not impact your costs if you live in Hawaii or Massachusetts, as state laws forbid vehicle insurance providers from making use of age as a ranking variable. Additionally, gender impacts your premium in many states.

Being entailed in an at-fault mishap will have an effect on your automobile insurance. credit score. The quantity of time it will remain on your driving document depends upon the severity of the crash as well as state laws. As one of one of the most major driving cases, receiving a DUI conviction commonly boosts your auto insurance costs greater than an at-fault crash or speeding ticket.

Some Known Factual Statements About Responsive Auto Insurance Review [2022]: Is It A Good Option ...

Exactly how a lot does cars and truck insurance cost by credit rating? Statistically, drivers with poor credit scores file much more claims and have higher claim severity than drivers with excellent credit rating, according to the Triple-I. This suggests that, generally, the better your credit history score, the reduced your costs. Your insurance credit scores rate is identified by each car insurance carrier and is based upon various factors; it possibly won't precisely match the scores from Experian, Trans, Union or Equifax as it is a credit-based insurance policy score, not a credit history.

These shared features can include: The high rate tag of these automobiles often come with costly components and specialized understanding to fix in the occasion of a case.

Insurance holders who drive less miles a year commonly get reduced rates (although this mileage classification varies by firm). Exactly how to discover the best cars and truck insurance policy prices, Acquiring car insurance does not need to imply damaging the financial institution; there are methods to save. cheapest car insurance. Discount rates are among the most effective methods to decrease your costs.

Below are several of the most typical insurance coverage discount rates in the U.S. Drivers that have no automobile insurance claims on their document for the past numerous years normally qualify for financial savings. You can commonly minimize your automobile insurance policy premium when you bundle your car insurance coverage plan with a house insurance plan or an additional kind of plan offered by your insurance firm, earning price cuts on both policies. If your car is funded or rented, it's most likely that you will certainly have to carry full insurance coverage on your car., to cover your vehicle's damages.

5 Simple Techniques For How Much Is Car Insurance A Year - Youtube

liability vehicle insurance trucks insure

liability vehicle insurance trucks insure

Having this additional coverage does suggest that your automobile insurance coverage may be much more pricey than if you were only bring the minimum obligation restrictions, but the advantage is that it may lower your out-of-pocket prices in the event of a mishap - vans.

Insurance providers file new prices with the departments of insurance policy in the states they offer annually, so your costs may go through increases or decreases that reflect these new rates. Method, Bankrate uses Quadrant Information Provider to assess 2022 prices for all postal code and providers in all 50 states and Washington, D.C.

Our base account vehicle drivers possess a 2020 Toyota Camry, commute 5 days a week and drive 12,000 miles annually. These are sample rates as well as must only be made use of for relative functions (cars). Prices were computed by evaluating our base account with the ages 18-60 (base: 40 years) used. Relying on age, motorists might be an occupant or home owner.

Bankrate ratings, Bankrate Ratings mainly reflect a weighted ranking of industry-standard ratings for financial strength as well as customer experience in addition to evaluation of priced estimate annual costs from Quadrant Info Services, covering all 50 states and Washington, D.C. We understand it is essential for drivers to be confident their financial defense covers the likeliest risks, is priced competitively and is provided by a https://s3.ap-northeast-2.wasabisys.com/unbiased-view-rental-car-insurance/index.html financially-sound company with a history of favorable client support (credit).

How Much Is Car Insurance? - Liberty Mutual Can Be Fun For Anyone

According to the Centers for Illness Control and Avoidance, vehicle drivers ages 15 to 19 are four times most likely to crash than older drivers, making vehicle crashes the No. 1 cause of death for teenagers. Even teens with clean accident records will deal with high cars and truck insurance policy prices for several years because of their absence of driving experience.

Lowering Car Insurance Policy Premiums for Teenage Chauffeurs, There are methods to decrease automobile insurance coverage prices for a teen motorist, however acquiring an auto for the teenager and putting him on his own policy isn't among them. The ordinary yearly price priced estimate for a teen chauffeur is $2,267. (This average includes all obligation insurance coverage levels.) Contrast that to an ordinary expense rise of $621 for adding a teenager to the parents' plan that indicates you'll pay 365 percent a lot more by putting the teenager on his or her very own plan.

But the most effective method to hold rates down is to see to it your teenager maintains a tidy driving document. Adding a teen to your insurance plan will certainly no doubt increase your rates, however there are points you can do to balance out the brand-new prices as well as lower your cars and truck costs.

"Vehicle drivers ought to analyze what insurance coverages are offered and identify what coverage they need. It's additionally important to search between various car insurance coverage service providers to see which one uses the most effective insurance coverage for the finest worth."If you have an interest in decreasing your vehicle insurance policy prices, check out an on-line industry like Legitimate to contrast multiple suppliers at the same time and also pick the choice that best fits your needs.

96% Of American Drivers Don't Understand ... - Yahoo Finance Can Be Fun For Everyone

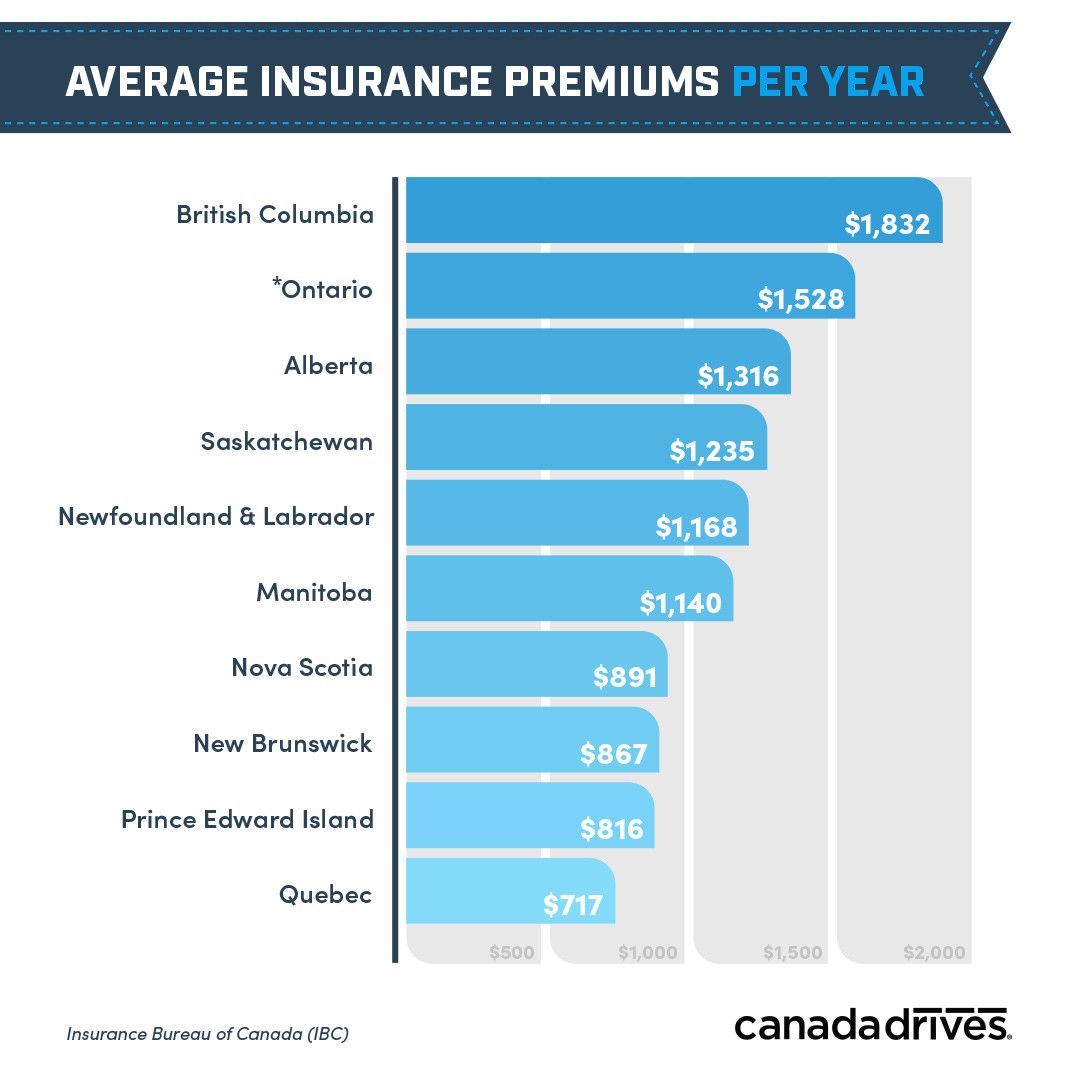

Some aspects that influence a location's car insurance costs consist of the expense of repairs in that state, costs of clinical aid and also the prestige of all-natural disasters. "Some of the most essential variables are the kinds of vehicles in each state, the typical cost of treatment, the frequency as well as severity of collisions, direct exposure to natural calamity damage and the price of auto theft and also criminal damage," the study states - insurance companies.

On the reverse side, Louisiana chauffeurs see the greatest premiums with a standard of $2,154 per year, or $180 per month. No matter of what state motorists are in, there are still numerous methods to ensure they are paying the best price for their auto insurance coverage, consisting of comparing auto insurance prices estimate from numerous service providers. cheapest car insurance.

There are numerous factors that determine the expense of automobile insurance coverage, and also chauffeurs can take actions proactively to ensure their premiums remain low, or to service lower auto insurance costs (insurance). Below are a few of the leading methods to decrease your automobile insurance policy expenses: There are several factors that go into figuring out the price of your vehicle insurance coverage.

Some car insurance policy companies provide excellent pupil discounts to teen vehicle drivers. When it comes to car insurance, loyalty does not pay. Car insurance coverage firms use a motorist's credit background as one factor that identifies the rate they will pay.

In 2018 the price of car insurance policy went up 4. It's frequently far better to pay vehicle insurance coverage in complete - insured car.

However if you want to pay regular monthly, you might have the ability to get a price cut by making use of digital funds transfer (EFT) for the settlements. One of the most effective methods to reduce your auto insurance policy price is to contrast quotes from multiple firms. Due to the fact that price can differ by thousands of dollars amongst insurance companies for the very same protection, going shopping around can actually pay off.

insurance car insured car insurance affordable

insurance car insured car insurance affordable

Car insurance rates are not cheaper based on whether you own a car or money it. Insurance can end up being more affordable when you possess the vehicle since you have extra option in insurance coverage.

All about Full Coverage Car Insurance Cost Of 2022

The average vehicle insurance cost for full coverage in the United States is $1,150 annually, or about $97 monthly. No insurance coverage plan can cover you as well as your auto in every situation. But a 'full insurance coverage cars and truck insurance coverage' policy covers you in the majority of them. Full protection insurance policy is shorthand for vehicle insurance coverage That cover not just your liability however damages to your automobile.